Information for non-profit organisations

Donors can donate to charitable activities of organisations worldwide which correspond to non-profit purposes according to the German tax-authorities’ standards via the TG programme.

The foundation ensures that the recipient organisation meets the legal requirements that are necessary for funding. This intensive test is carried out according to an established multi-stage procedure and is repeated at regular intervals.

The TGE Network has established itself as a suitable instrument for international donation campaigns.

For this purpose, it created a new online portal in 2020, through which organisations can manage their profiles, submit applications, and announce changes.

Are you responsible for a social organisation and would you like to give your European donors an easy way to make a tax-deductible donation?

>> If you would like to register with the Transnational Giving Programme, contact us at: tg@maecenata.eu

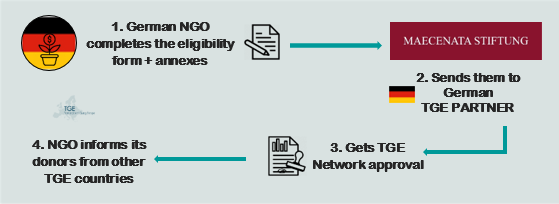

Registration process

1. If you would like to register, we will send you a link to the application form on request.

There you will be asked to upload the following documents:

- Articles of association (original)

- Articles of association translated into English (these do not necessarily have to be notarised. In particular, we need the passages on the purpose, legal form and regulation of the use of funds in the event of dissolution in English)

- Proof of your organisation’s bank account (blackened bank statement with IBAN and account holder)

- List of committee members (name, place of residence, date of birth)

- Last annual invoice or test report (min. balance sheet) in English

- If available, project reports / proof of work (e.g. annual report) in English

- Valid exemption notice or annex to the corporate tax assessment as proof of non-profit status

Please also indicate the European countries where potential donors may be based.

2. After we have reviewed your application files successfully, we will forward your documents to our network partners in the countries you have specified. They in turn check whether you are recognised as charitable under the law applicable there.

The review process can take some time. Please inform us or the TGE partners in the respective countries directly if donors are already waiting for TGE approval.

3. As soon as the review process was successful on both sides, foreign donors in the respective countries can donate to you via the respective network partners. The transaction process differs depending on the partner country and will be communicated to you after the review, including your account details.

After you have successfully registered with us and our partners, you can receive

- a personalised donation link and QR Code for your website (available upon request)

Donation transfer

We transfer all donations received for you as a lump sum on a quarterly basis, together with a table that contains all the information about the donors and donations that we have received for you. (Donations received between January and March will be transferred in April.)

To cover the effort and to further develop the network, part of the donation is retained as a free donation share. This amounts to 5% of the first 100,000 EUR, then 1% up to a maximum of 50,000 EUR per donation (as of December 2020).

Donations that cannot be made through the TGE network (e.g. to the USA) can also be forwarded through the Maecenata Foundation. In these cases, 5% of the first 100,000 EUR, then 1% to 1,100,000 EUR, then 0.5% up to the full donation amount will be retained as a free donation share.

If necessary, we can however arrange special funding on request, e.g. if you receive a larger individual donation. Special transfers contain a single donation or containing all donations from a single month as a billing period.

Our donation database is updated monthly. Information about donations that do not come through the online donation tool will only be available after the updates. Upon request, we will send you information about the donations received in the last month. If you want to know whether a particular donation has already arrived, we need to know the name of the donor.

Together with the transfer, we will send you a list of all donations that we have received for you, as well as the ‘Details of Transfer’ (DoT) form. After receiving the funds, you should sign and return the DoT to confirm funding.

The donors receive tax certificates for the full amount of their donations over 300 EUR per month after receipt of the donation. For donations under 300 EUR, the account statement together with this form is sufficient.

Proof of application of funds

Your organisation is obliged to report on the use of the funds which were received via Transnational Giving.

That is why we ask you for an annual report on how you used the funds that you received from us. You can use the attached template (‘Funding Report’) for this purpose. It is kept to a minimum to make reporting as quick and easy as possible.

We ask you to fill out the template in English and to email us a signed copy.

In addition, your annual report and accounts (or any other document containing the relevant information) can also be submitted.

Please also note that we may ask for more detailed information should the German tax authorities require it.